DOGE Price Prediction: Technical Breakout and ETF Catalysts Signal 20% Upside

#DOGE

- DOGE's price is above the 20-day moving average, indicating bullish technical momentum

- ETF launch news and strategic partnerships are driving positive market sentiment

- MACD histogram positivity suggests growing buying pressure for potential breakout

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

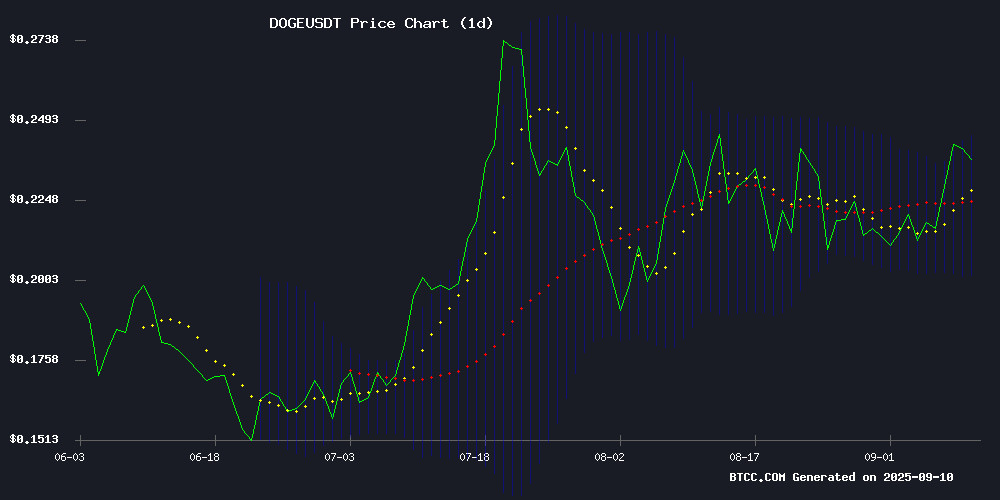

DOGE is currently trading at $0.24195, positioned above its 20-day moving average of $0.223436, indicating underlying bullish momentum. The MACD reading of -0.000974 suggests some near-term consolidation, though the positive histogram at 0.003393 points to building upward pressure. With the price approaching the upper Bollinger Band at $0.245605, John from BTCC notes that a breakout could signal further gains toward the $0.25 resistance zone.

Market Sentiment Boosted by ETF Developments and Strategic Partnerships

The launch of a Dogecoin ETF has generated significant optimism, driving both retail and institutional interest. Partnerships like the Dogecoin Foundation's collaboration with Bitstamp for treasury management add credibility to DOGE's ecosystem. While some analysts question its utility for ETF viability, John emphasizes that growing adoption and green tech integrations, as seen with CleanCore Solutions, reinforce DOGE's long-term investment case.

Factors Influencing DOGE's Price

Dogecoin ETF Debut Sparks Rally as Technicals Signal Further Upside

Dogecoin surged 4% to reclaim the $0.24-$0.25 range amid heavy trading volume exceeding 1.5 billion tokens, fueled by anticipation of the first U.S. Dogecoin ETF launch. REX-Osprey's 'DOJE' fund begins trading September 11, marking a watershed moment for memecoins in regulated markets.

Whale accumulation of 280 million DOGE in the past week suggests institutional players are positioning ahead of the ETF debut. Technical analysts confirm a pennant breakout pattern, with sustained momentum above $0.25 potentially propelling prices toward $0.28-$0.30 resistance levels.

The rally showcased textbook accumulation dynamics - an early sell-off to $0.236 met with aggressive buying, followed by tight consolidation between $0.238-$0.242 before a decisive breakout to $0.245. Derivatives markets and social sentiment indicators now flash the strongest bullish signals since April's meme coin frenzy.

Dogecoin ETF Nears Launch, Marking a Surreal Turning Point in Finance

The first U.S. Dogecoin ETF, DOJE, is set to launch this week, allowing investors to buy DOGE directly from brokerage accounts without the need for crypto wallets. Rex-Osprey's innovative filing under the Investment Company Act of 1940 expedited the approval process, sidestepping the delays faced by most crypto ETFs.

Bloomberg analyst Eric Balchunas notes the paradox: 'This is the first-ever U.S. ETF to hold something that has no utility or purpose.' Dogecoin, once a meme, now trades with the same accessibility as blue-chip stocks. Wall Street's embrace of DOGE signals a broader acceptance of meme coins in mainstream finance.

Dogecoin Foundation's House of Doge Partners with Bitstamp for Treasury Management

House of Doge, the corporate arm of the Dogecoin Foundation, has secured Bitstamp by Robinhood as the official trading and custody platform for its newly established Dogecoin Treasury. The partnership aims to enhance stability, transparency, and utility for DOGE holders.

CleanCore Solutions, Inc., collaborator in the treasury's launch, confirmed the funds will be held on Bitstamp—a platform recognized for its regulatory compliance and growing crypto market share. The move unlocks potential yield-bearing opportunities and bolsters Dogecoin's financial infrastructure.

"We're proud to support House of Doge and CleanCore with our secure, regulated platform," said Nicola White, Robinhood's VP of Crypto Institutions. The alliance seeks to strengthen ties with Dogecoin's community—miners, traders, and long-term holders alike—while fostering a more structured DOGE economy.

Bloomberg Analyst Doubts Dogecoin's Utility for ETF Viability

Eric Balchunas, a senior ETF analyst at Bloomberg, has reaffirmed his stance on Dogecoin's lack of utility, despite pushback from the crypto community. In a recent post on X, Balchunas questioned the fundamental value proposition of the meme-inspired cryptocurrency.

The comments come amid growing speculation about the potential for a Dogecoin ETF. Balchunas' skepticism highlights the ongoing divide between traditional finance perspectives and crypto-native enthusiasm for assets like DOGE.

CleanCore Solutions (ZONE) Stock Surges on Green Tech and Dogecoin Treasury Strategy

CleanCore Solutions (ZONE) shares rallied 26.21% to $4.43 on September 9, fueled by record revenues from its aqueous ozone cleaning systems and a controversial treasury allocation to Dogecoin (DOGE). The stock later retreated 8.52% in pre-market trading as investors digested the dual strategy.

The company's industrial division continues gaining traction, with hospitals, airports, and schools adopting its chemical-free cleaning technology. This growth coincides with CleanCore's unorthodox move to diversify corporate reserves into meme cryptocurrency DOGE—a bet positioning ZONE at the intersection of cleantech and crypto finance.

Is DOGE a good investment?

Based on current technicals and market developments, DOGE presents a compelling short-to-medium-term investment opportunity. The price trading above the 20-day MA, combined with bullish ETF news and strategic partnerships, suggests potential upside toward $0.30. However, investors should monitor key resistance levels and broader crypto market trends.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.24195 | Above 20-day MA, bullish |

| 20-Day MA | $0.223436 | Support level |

| Upper Bollinger Band | $0.245605 | Near-term resistance |

| MACD Histogram | 0.003393 | Positive momentum building |